michigan sales tax exemption number

General Information on State Sales Tax. The buyer must present the seller with a completed form at the time.

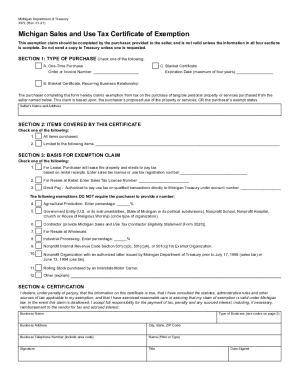

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

Sales Tax Return for Special Events.

. The buyer or lessee would check the box Rolling Stock purchased by an Interstate Motor Carrier. In Michigan certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. 2022 Aviation Fuel Informational Report - - Sales and Use Tax.

The required information is Taxpayer ID Type Taxpayer ID and Exempt Sales Account Number. This claim is based upon. If your business sells products on the internet such as eBay or through a storefront and the item is shipped within the same state sales tax must be collected from the buyer and the sales tax must be paid on the collected tax to the state.

A Resale Certificate is obtained by filling out Form 3372 from the Department of Treasury titled Michigan Sales and Use Tax Certificate of Exemption. Notice of New Sales Tax Requirements for Out-of-State Sellers. For transactions occurring on and after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus under amendments to the General Sales Tax Act MCL 20552b and Use Tax Act.

The purchasers proposed use of the property or services. Obtaining Your Farms Number After you have researched your particular states regulations for farming and determined that you qualify for tax exemption or. Sales tax of 6 on their retail.

Most common agricultural input expenses are exempt from Michigan Sales Tax. Ranked 21st highest by per capita revenue from the statewide sales tax 852 per capita Michigan has a statewide sales tax rate of 6 which has been in place since 1933. Sales Tax Return for Special Events.

The Michigan Department of Treasury does not issue tax exempt numbers. All fields must be. Ad Fill Sign Email MI DoT 3372 More Fillable Forms Register and Subscribe Now.

Form Number 2021 Form Name. Several examples of exemptions to the states. Streamlined Sales and Use Tax Project.

It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed. Michigan sales tax and farm exemption. What is your tax exempt number.

An application for a sales tax license may be obtained on our web site. How do I obtain a tax exempt number to claim an exemption from Sales or Use Tax. Sales Tax Exemptions in Michigan.

Purchaser Refund Request for a Sales or Use Tax Exemption. Fill out the Michigan 3372 tax exemption certificate form. Form 3372 Michigan Sales and Use Tax Certificate of Exemption is used to claim exemption from Michigan Sales and Use Tax.

CityLocalCounty Sales Tax - Michigan has no city local or county sales tax. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. In order to register for sales tax please follow the application process.

Step 5 Fill out the name of the business address phone number signature title and date. Present a copy of this certificate to suppliers when you wish to purchase items for resale. Ad Create Edit Sign a Tax Exempt Certificate Today - Start By 815.

Purchaser Refund Request for a Sales or Use Tax. All claims are subject to audit. Interstate fleet motor carriers who qualify for exemption may claim exemption from sales or use tax by providing the seller or lessor with the prescribed Michigan Sales and Use Tax Certificate of Exemption form 3372.

The purchaser completing this form hereby claims exemption from tax on the purchase of tangible personal property or services purchased from the. Retailers - Retailers make sales to the final consumer. Michigan does not issue tax-exempt numbers so sellers must have this form in order for you to be granted your.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. 2022 Sales Use and Withholding Taxes MonthlyQuarterly Return. Direct Pay -Authorized to pay use tax on qualified transactions directly to Michigan Treasury under account number.

Michigan Sales and Use Tax Certificate of Exemption. Ad New State Sales Tax Registration. If you are looking to purchase goods in Michigan and you have tax-exempt status you need to fill out this form and present it to the seller at the time of your purchase.

Michigan State University Extension will often get phone calls from farmers wondering how they can get a tax exempt number so they do not have to pay sales tax. Enter Sales Tax License Number. Michigan Sales and Use Tax Certificate of Exemption.

Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. Warren Schauer Michigan State University Extension - March 20 2013. Obtain a Michigan Sales Tax License.

Therefore you can complete the 3372 tax exemption certificate form by providing your Michigan Sales Tax Number. Tax-exempt organizations are generally required to have and use an employer identification number EIN. OR the purchaser s exempt status.

Form Number Form Name. 2021 Aviation Fuel Informational Report - - Sales and Use Tax. This page discusses various sales tax exemptions in Michigan.

For other Michigan sales tax exemption certificates go here. How do I get a farm sales tax exempt in Michigan. Michigan Sales and Use Tax Certificate of Exemption Fillable Form 3372.

You can get those details from the tax exemption certificate the buyer will provide you and its details must match their invoice details. However if provided to the purchaser in. Step 4 Indicate the reason for sales tax exemption.

The state sales tax rate is 6. Verification of tax-exempt resale certificate can be carried out through the official Alabama State website. Seller s Name and Address.

Sales Tax Exemption Michigan information registration support. How to use sales tax exemption certificates in Michigan. 2021 Sales Use and Withholding Taxes MonthlyQuarterly Return.

Virtually every type of business must obtain a State Sales Tax Number. While the Michigan sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation. If a retailer is purchasing merchandise for resale check box number 2 and include their Sales Tax License Number.

Form 3372 Michigan Sales and Use Tax Certificate of Exemption is used in claiming exemption from Michigan sales and use tax. Municipal governments in Michigan are also allowed to collect a local-option sales tax that ranges from 0 to 0 across the state with an average local tax of NA for a. Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions.

Tax-exempt organizations must use their EIN if required to.

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

Michigan Sales Tax Exemption Fill Online Printable Fillable Blank Pdffiller

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

Michigan Sales Tax Small Business Guide Truic

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

Form 3372 Fill Out And Sign Printable Pdf Template Signnow

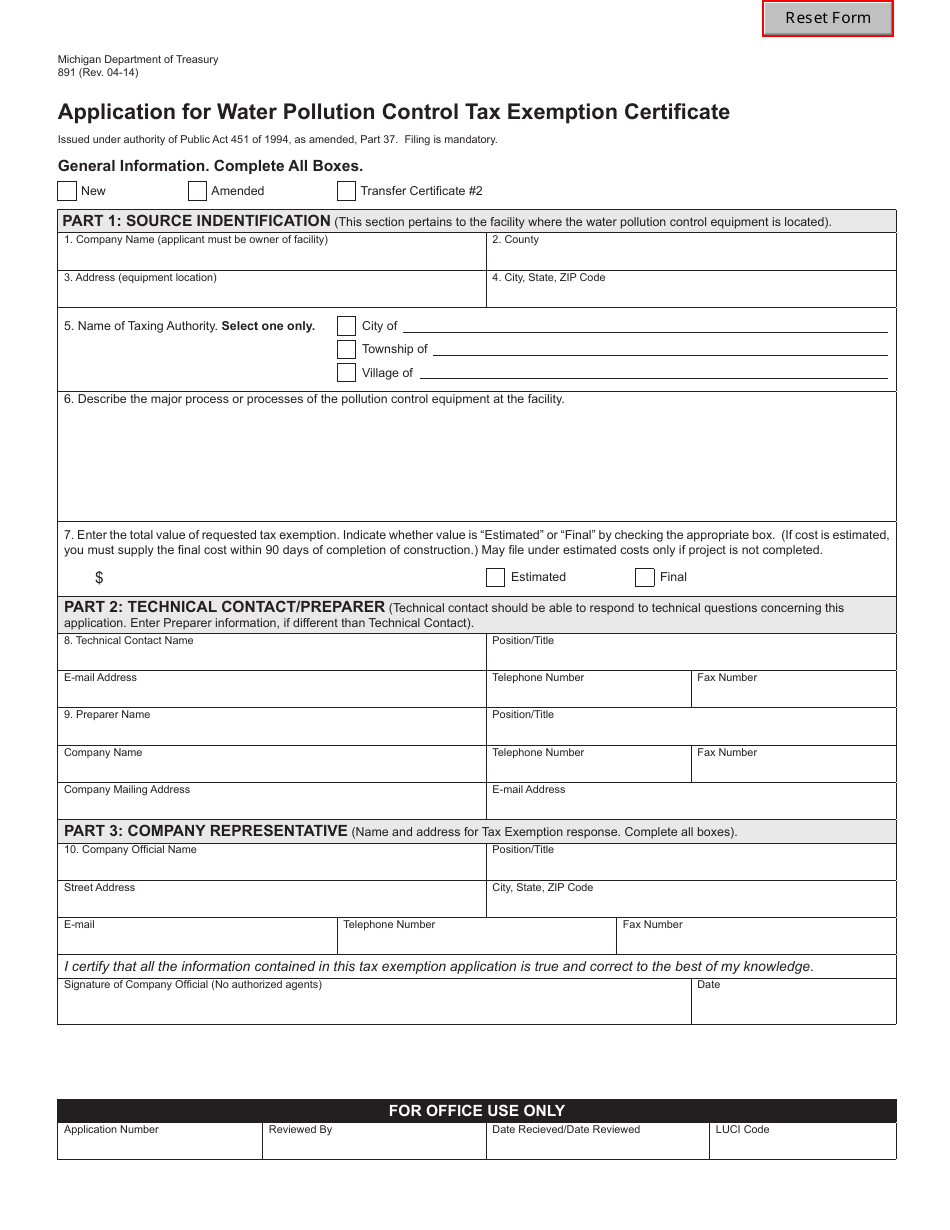

Form 891 Download Fillable Pdf Or Fill Online Application For Water Pollution Control Tax Exemption Certificate Michigan Templateroller

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

Michigan Resale Certificate Fill Out And Sign Printable Pdf Template Signnow